Condo Insurance in and around Hannibal

Condo unitowners of Hannibal, State Farm has you covered.

Cover your home, wisely

Home Is Where Your Condo Is

When it's time to slow down, the retreat that comes to mind for you and your favorite peopleis your condo.

Condo unitowners of Hannibal, State Farm has you covered.

Cover your home, wisely

Condo Coverage Options To Fit Your Needs

You want to protect that unique place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as smoke, freezing of a plumbing system or vehicles. Agent Dick Wehde can help you figure out how much of this fantastic coverage you need and create a policy that works for you.

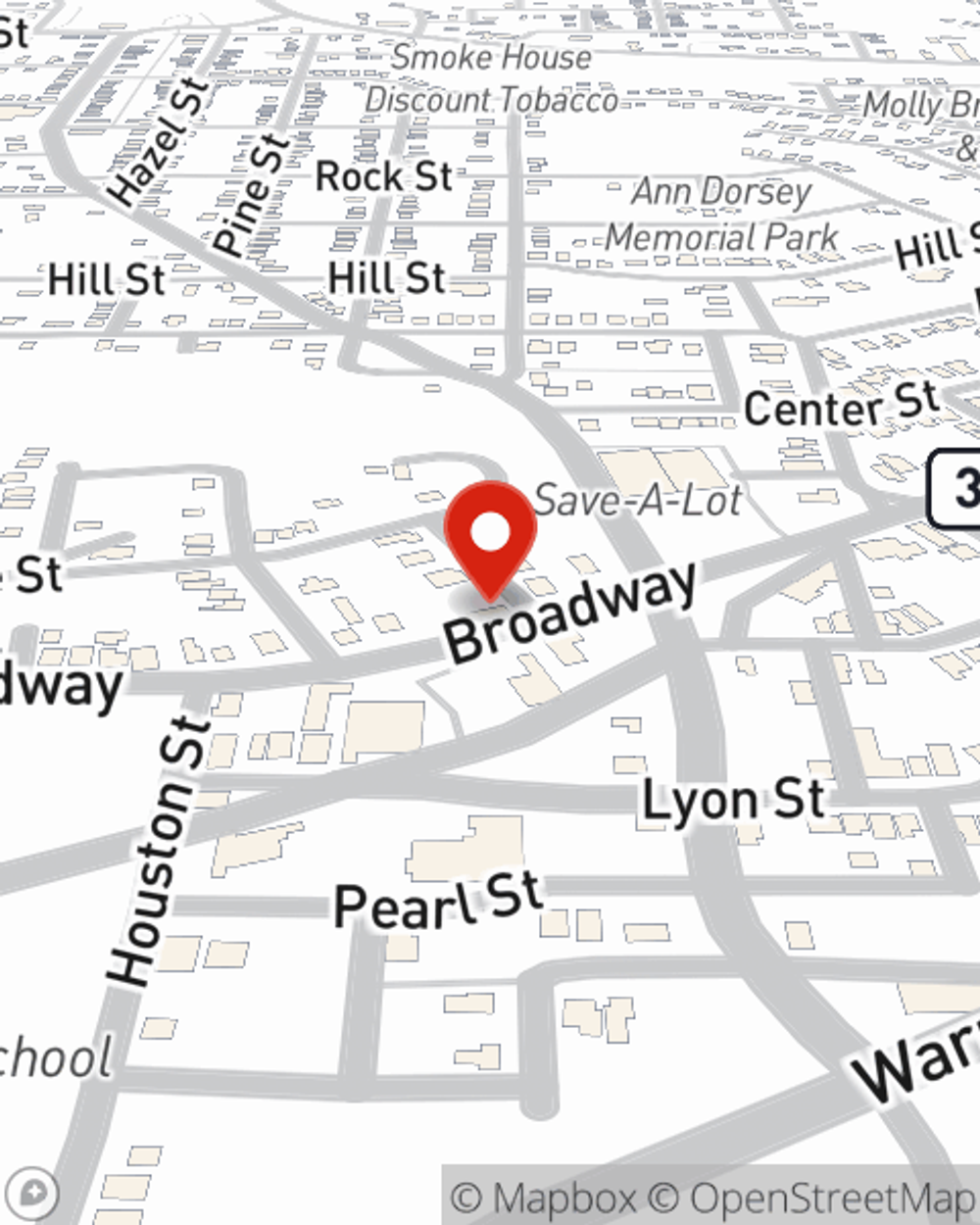

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Visit Dick Wehde's office today to see how you can meet your needs with Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Dick at (573) 221-0204 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.